Online Payments Management

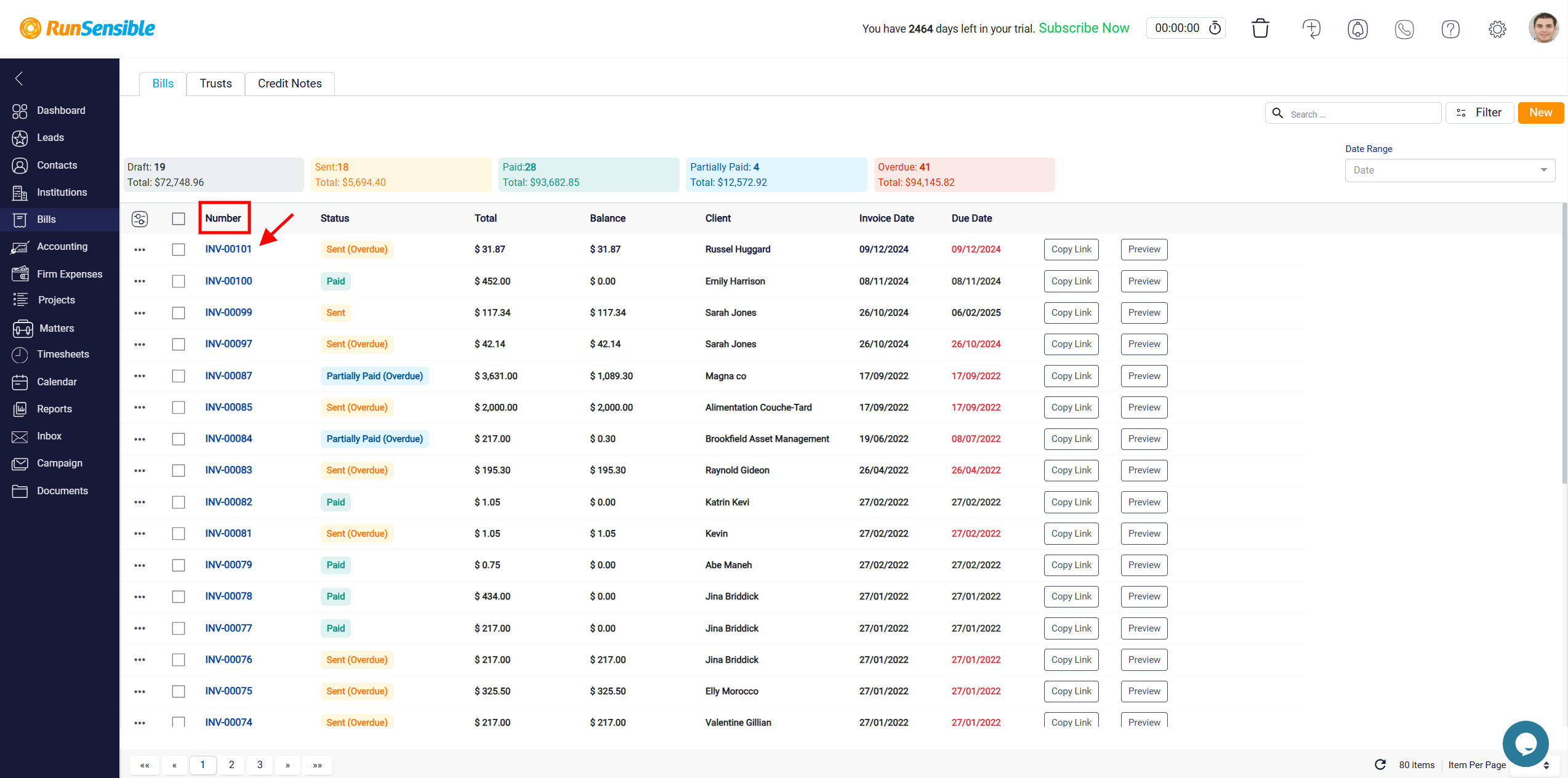

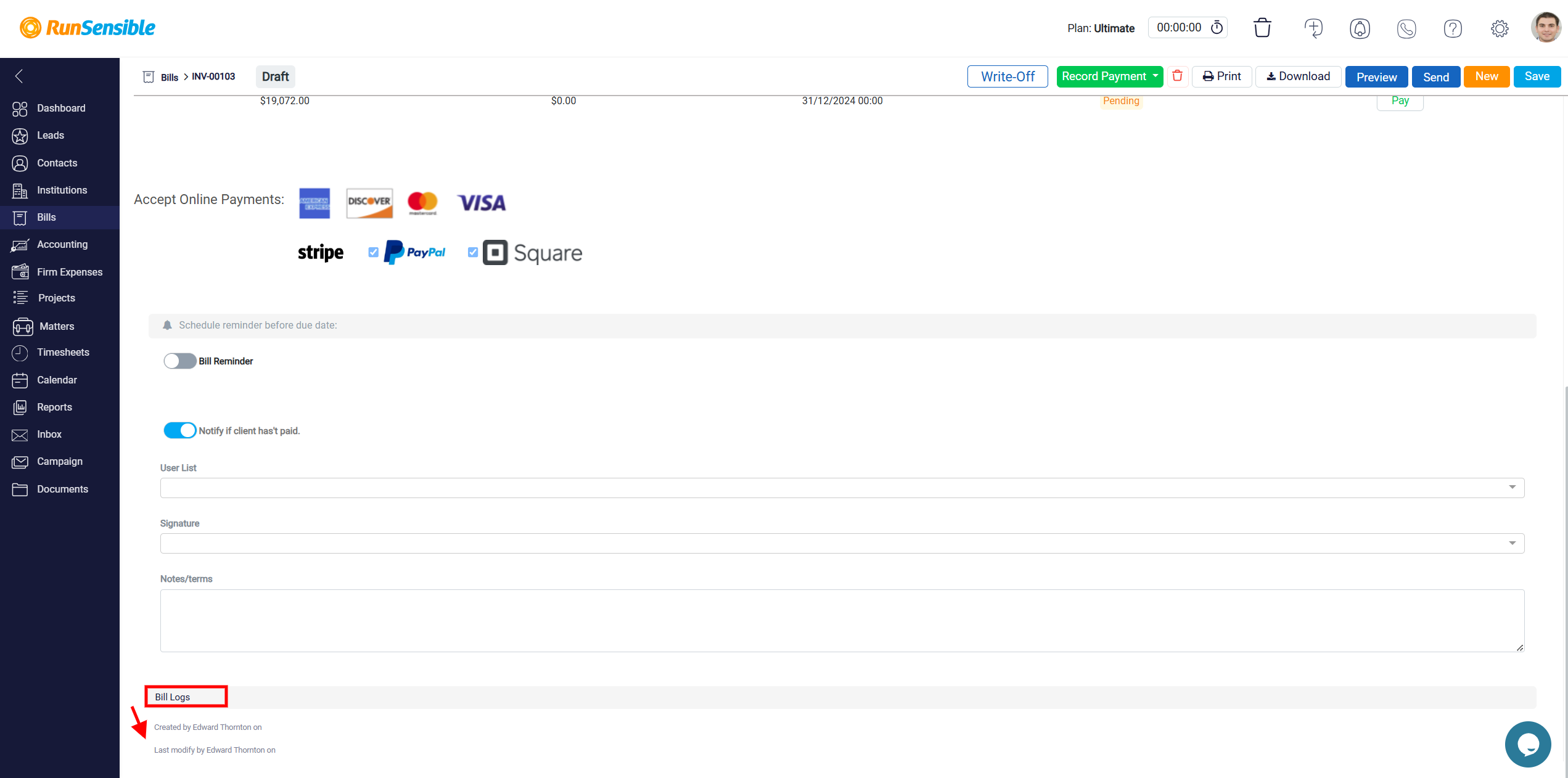

To manage the Online Payment, click on the bill’s Number link.

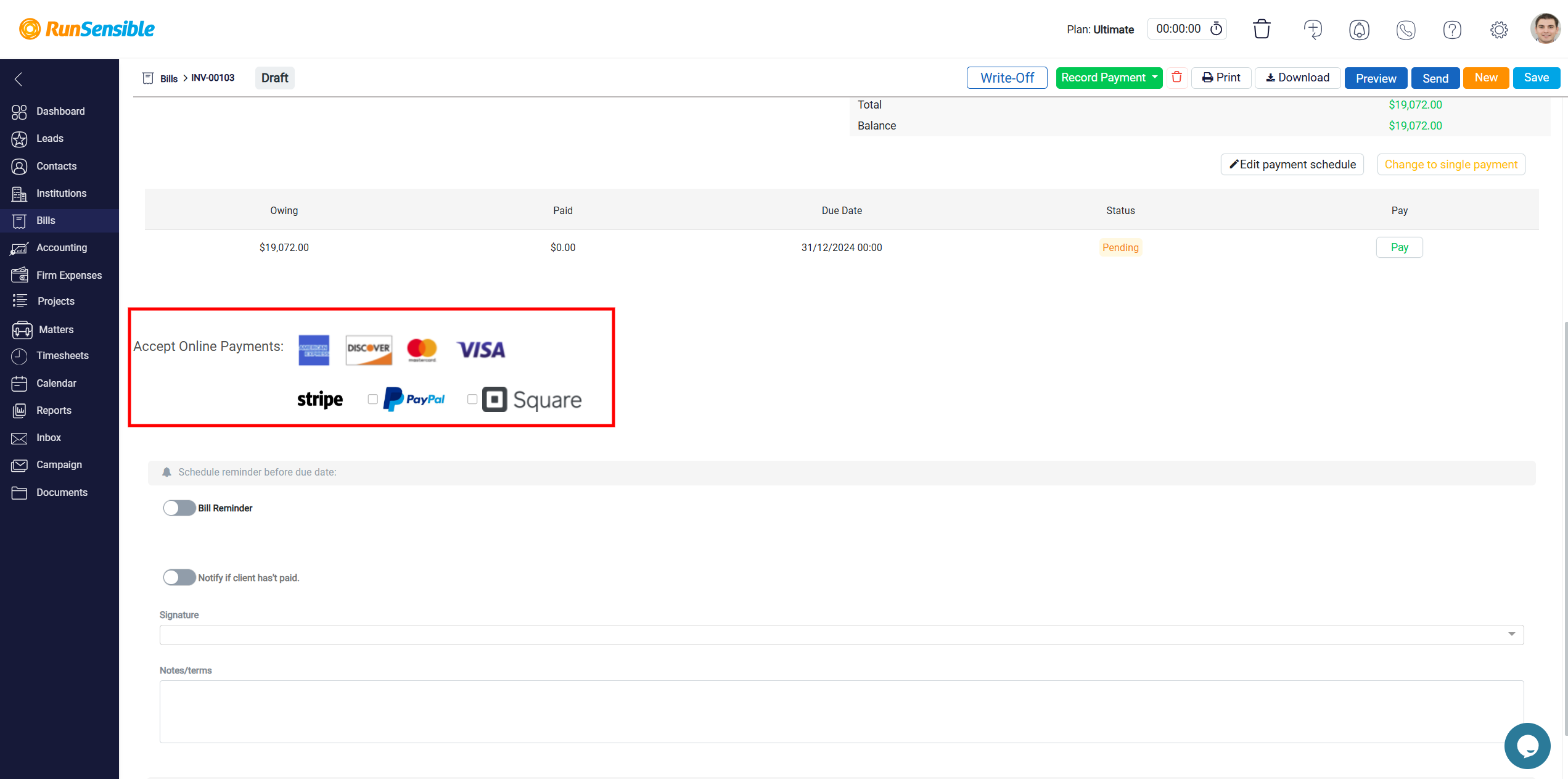

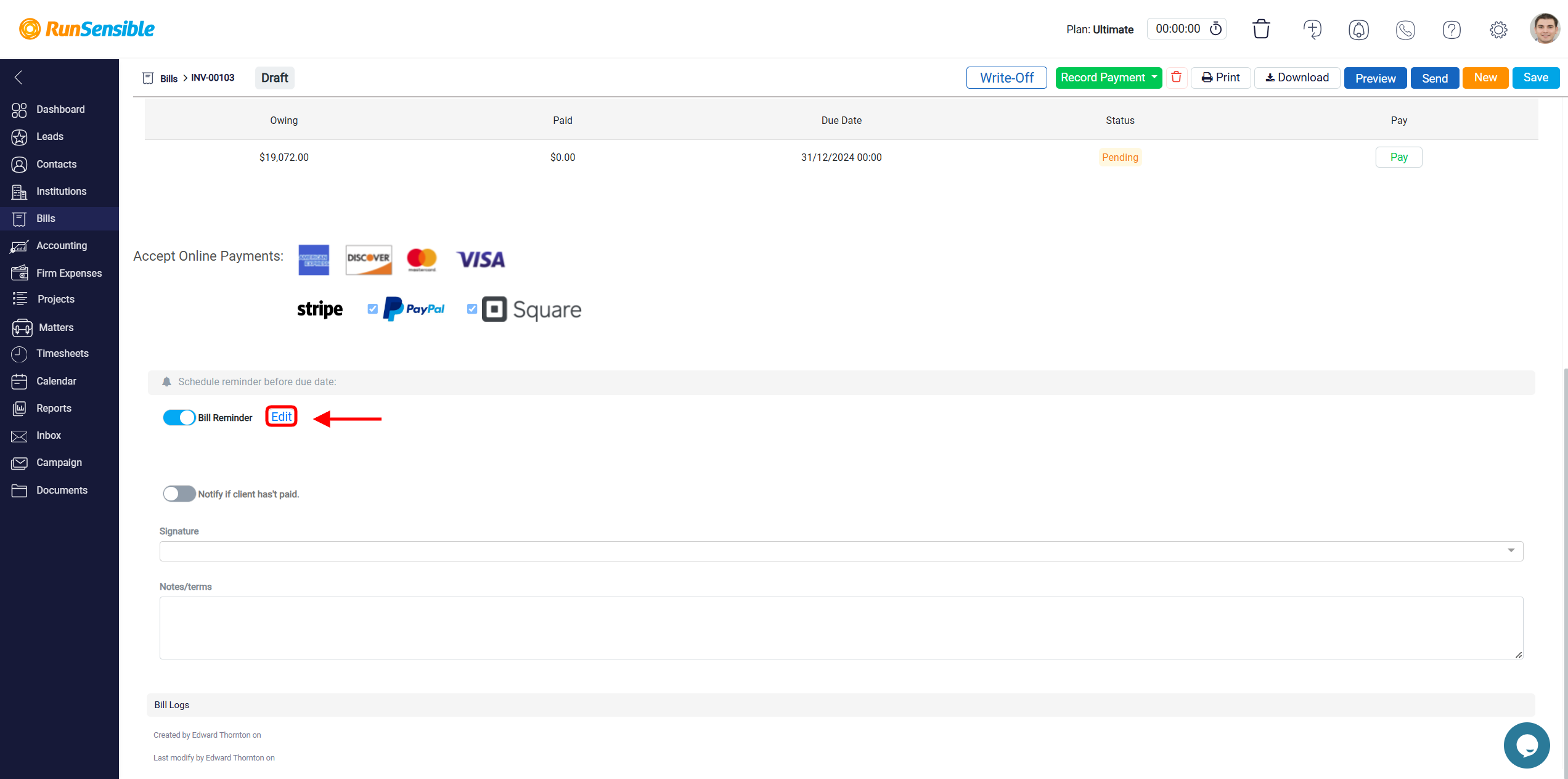

The online payment section includes well-known payment platforms such as Stripe, PayPal, and Square. Additionally, it accommodates major credit card brands like American Express, Discover, Mastercard, and Visa. This provides clients with flexibility and convenience in choosing their preferred method of payment.

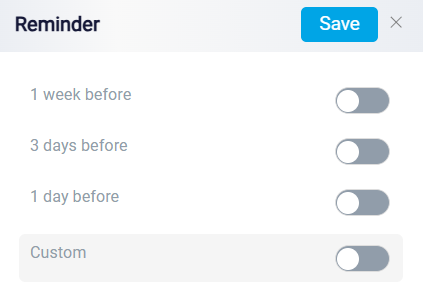

The Bill Reminders feature is designed to help users stay on top of their bill payments by providing timely notifications to avoid missed payments and maintain better financial control. You can easily activate this functionality using a toggle switch.

Once turned on, the system will automatically send reminders before the bill’s due date, ensuring users are informed and prepared to handle payments without delays. The Edit appears next to the Bill Reminder toggle in the billing interface.

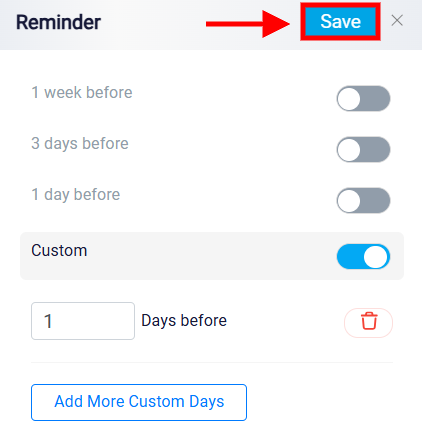

This button is designed to provide users with the ability to customize or adjust the settings related to bill reminders. Its purpose is to offer flexibility in managing client communications effectively. By clicking on the Edit button, you are presented with a range of options to tailor the reminder settings. These options might include setting the frequency of reminders, such as daily, weekly, or specifying a particular number of days before the due date. This ensures that reminders are sent out at the most appropriate times.

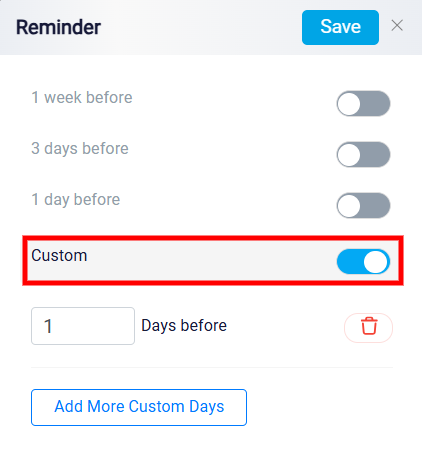

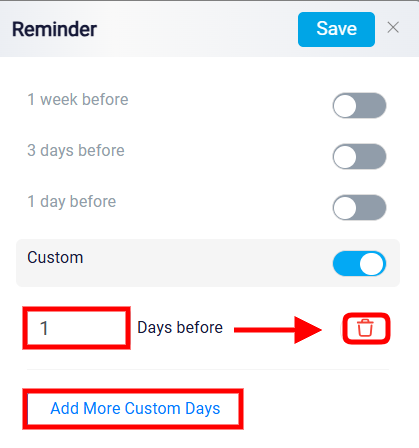

Additionally, there is a Custom reminder option that lets users define a specific time or day for their notification, offering flexibility beyond the preset choices. Each toggle switch provides a clear way to enable or disable reminders.

You can input the desired number of days along with a Trash icon next to it for deletion. There’s also a button labeled Add More Custom Days to add additional custom reminder times.

At the top right, there is a Save button to confirm the settings.

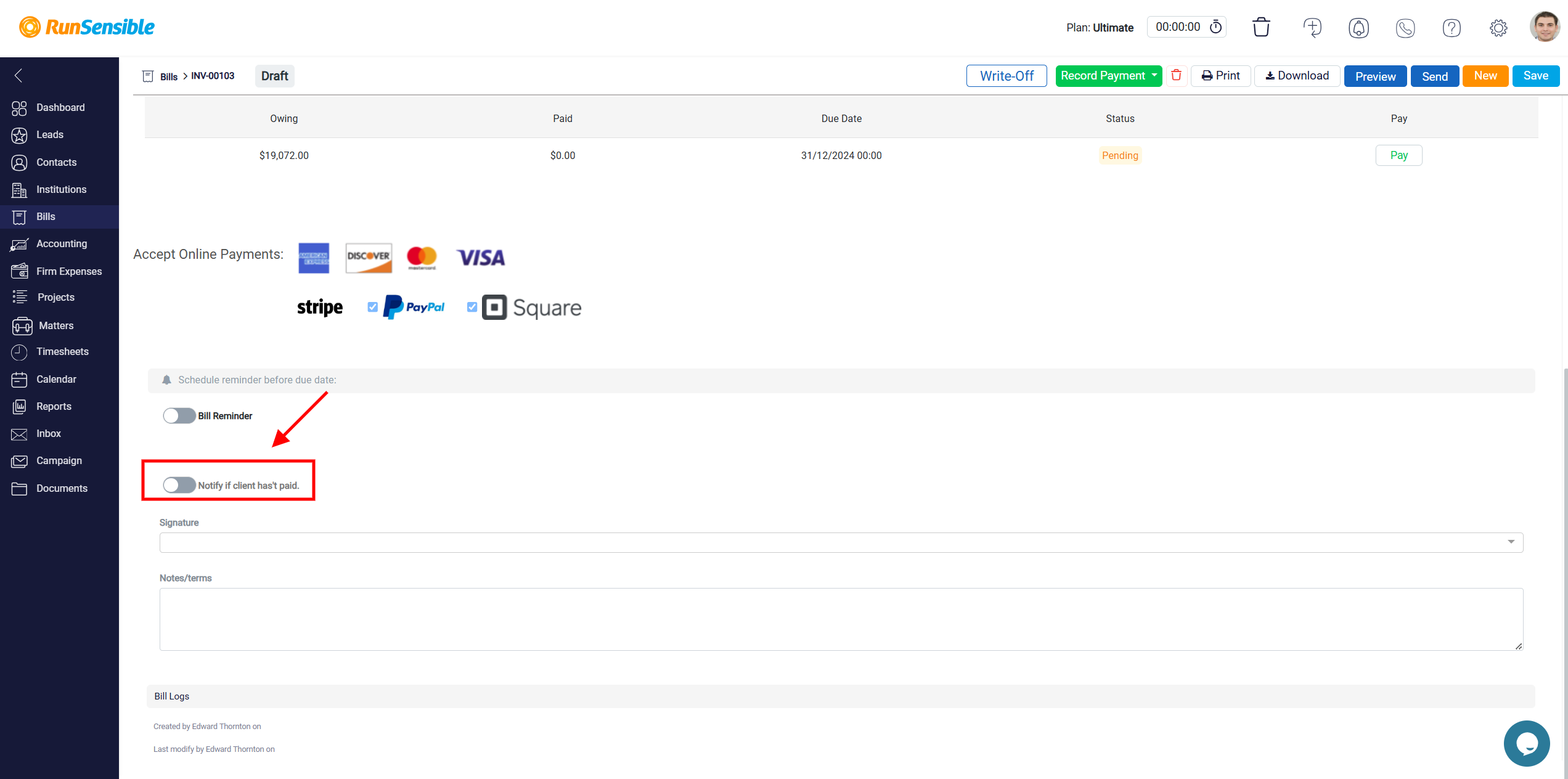

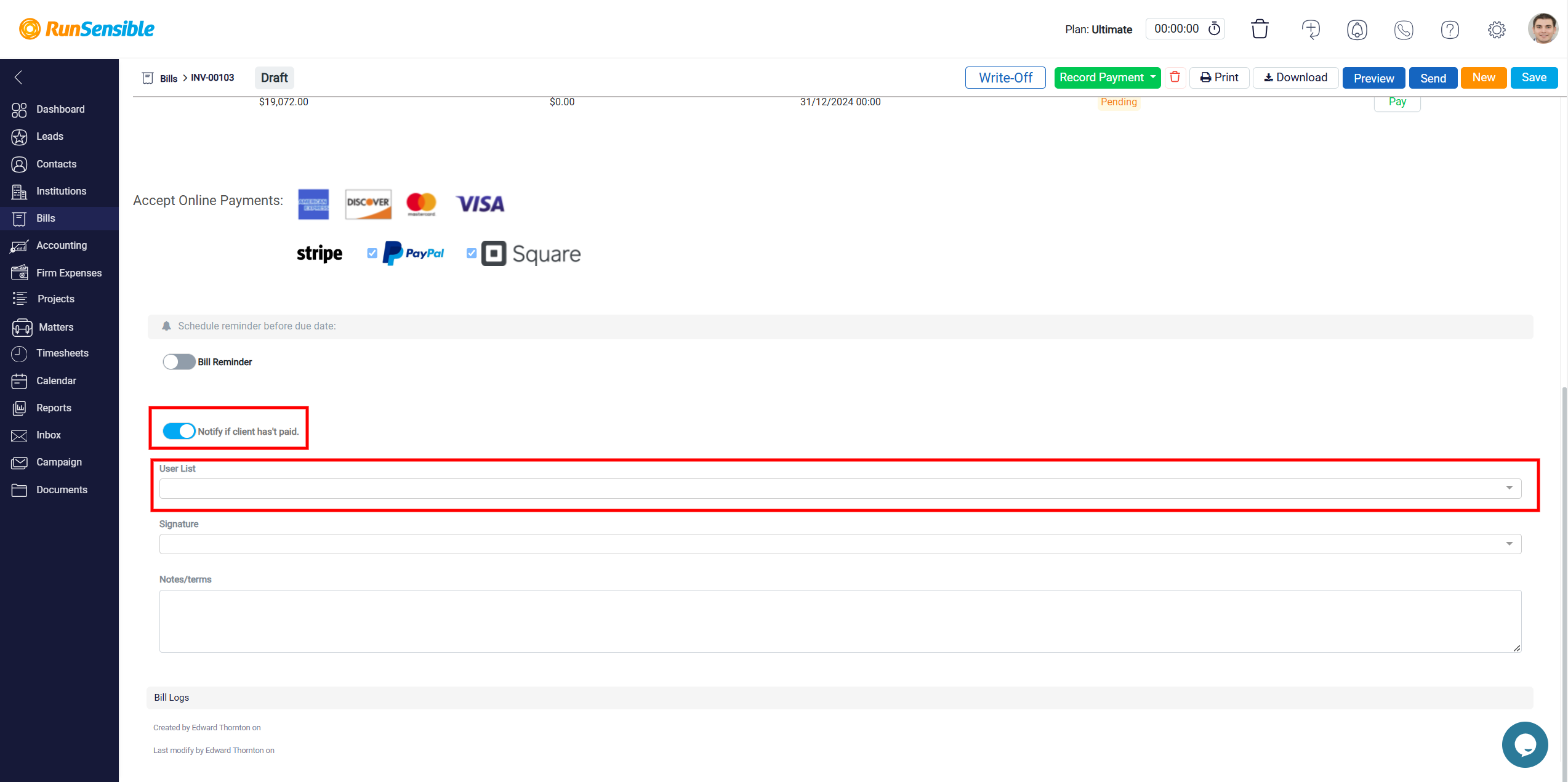

The Notify if client hasn’t paid option is designed to streamline the process of following up on overdue payments. By enabling this setting, the system will automatically send a notification when a client has not paid their invoice by the due date. This ensures that no unpaid bill goes unnoticed and helps the law firm maintain a steady cash flow.

When activated, this feature allows the system to monitor the payment status of each invoice. If the payment remains pending past the due date, a notification is triggered. Depending on the configuration, this alert can be sent to either the client, reminding them to settle the outstanding amount, or to internal staff, ensuring they are aware of overdue payments.

Below the toggle, there is a User List dropdown field, which allows you to specify who should receive these notifications. By selecting the appropriate individuals or teams, you can ensure that the right people are informed and can take timely action to resolve the payment issue.

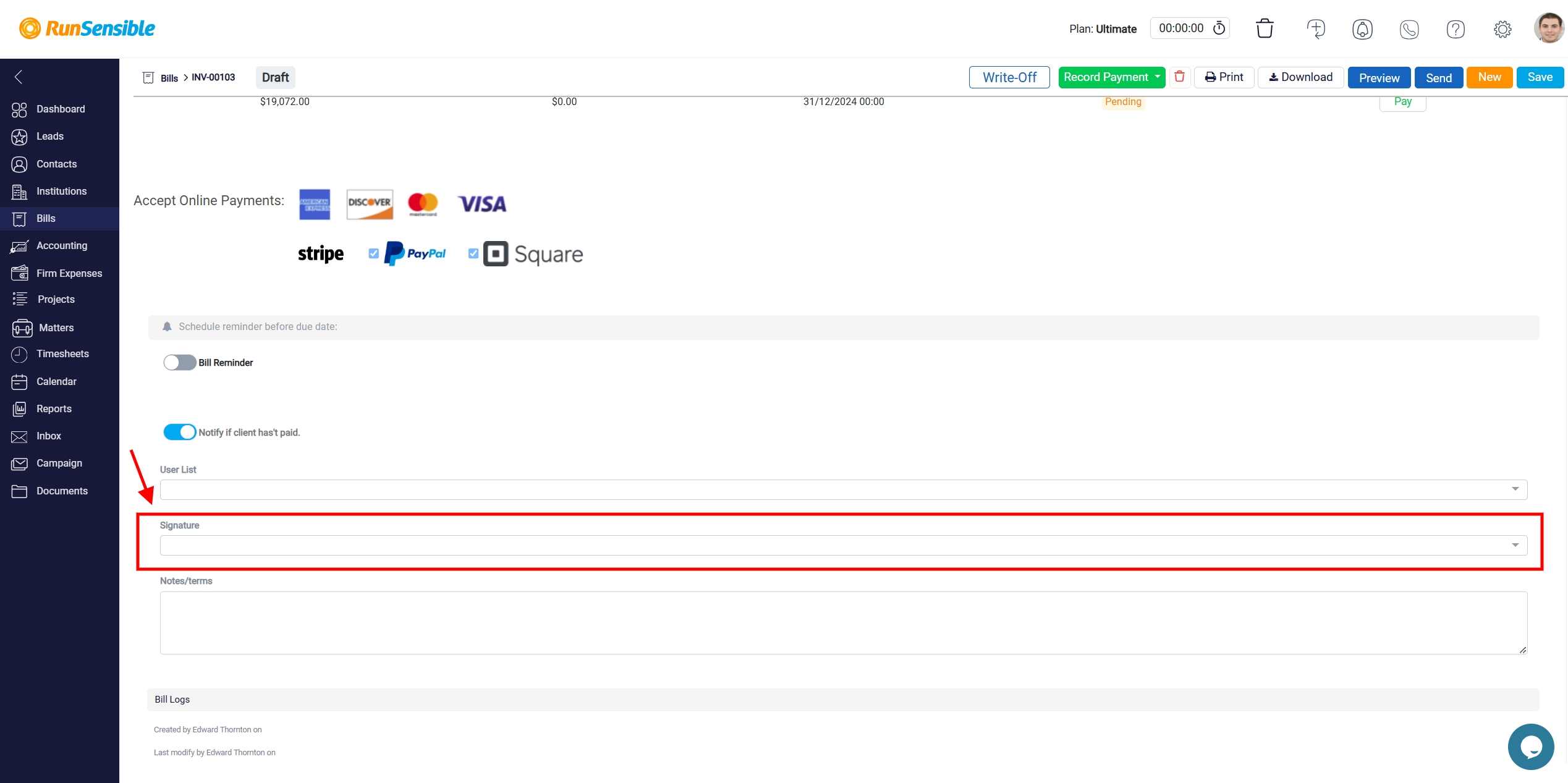

There is a designated section for adding a signature form the dropdown menu.

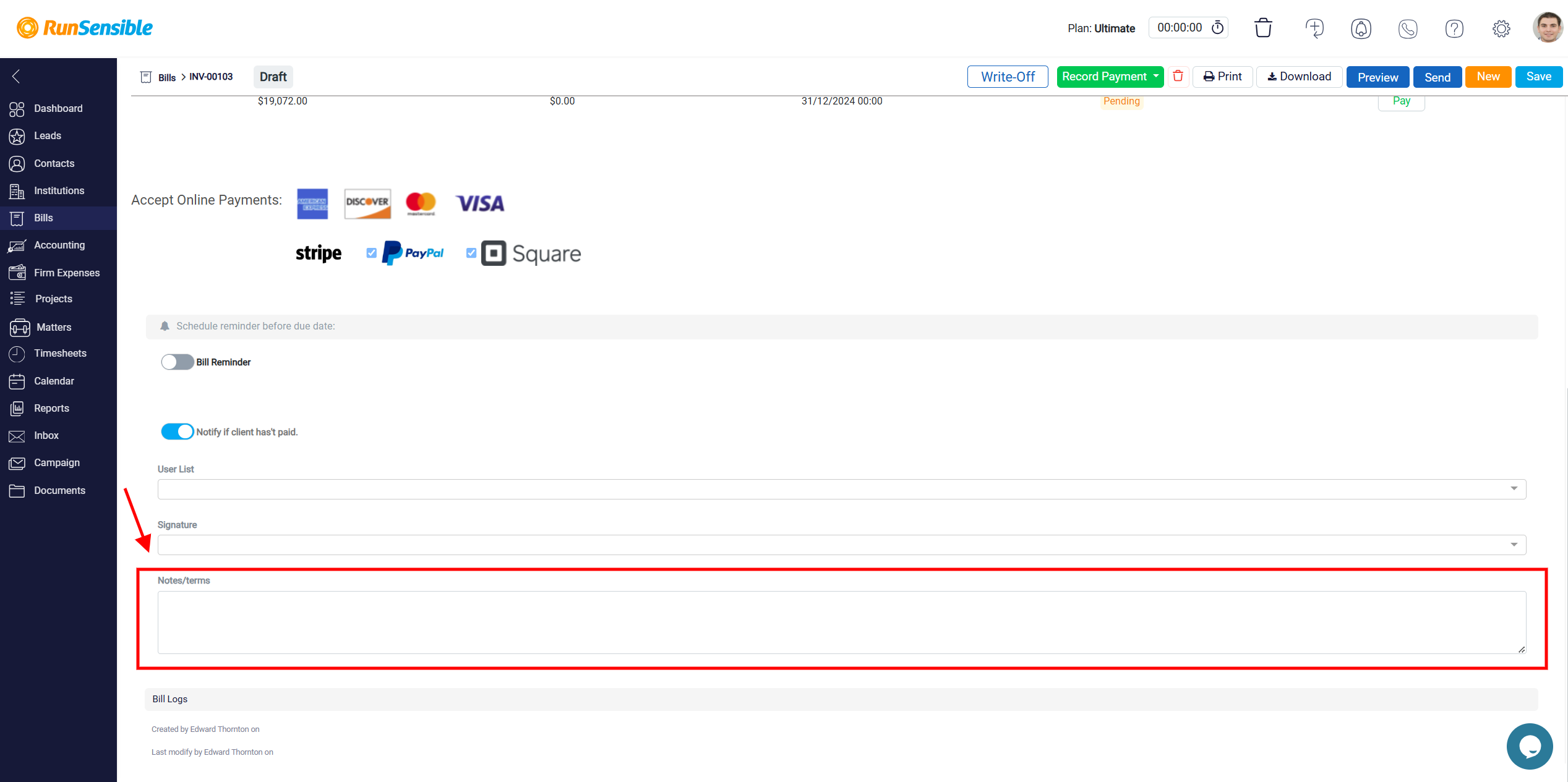

The Notes/Terms section in the image is designed for providing additional information or details associated with the invoice or payment. This area can be used to communicate key points effectively.

The Bill Logs is a tracking and auditing feature designed to provide a clear record of actions taken on the specific bill or invoice. It promotes transparency, accountability, and collaboration by providing a clear and reliable record of all interactions related to the bill. It is particularly useful in team environments where multiple users may handle the same invoice.

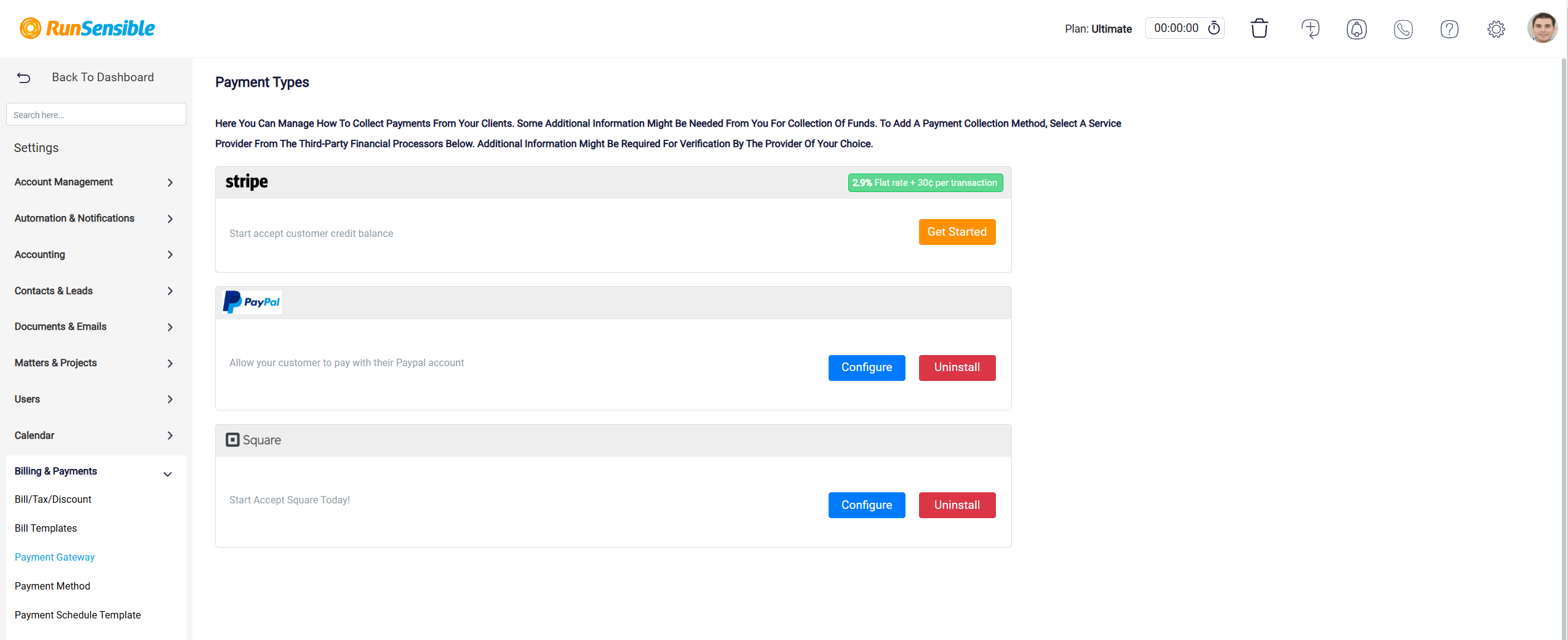

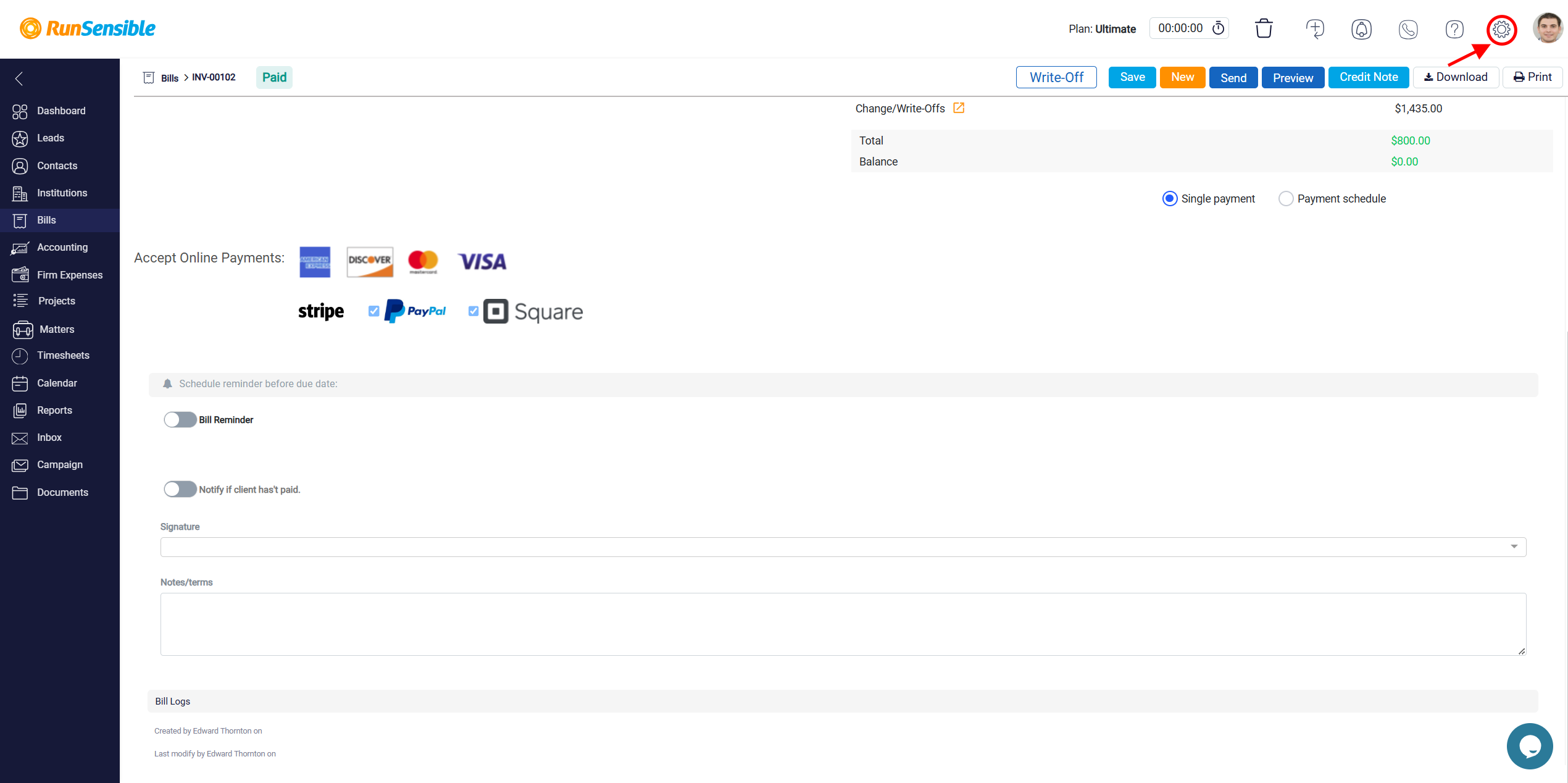

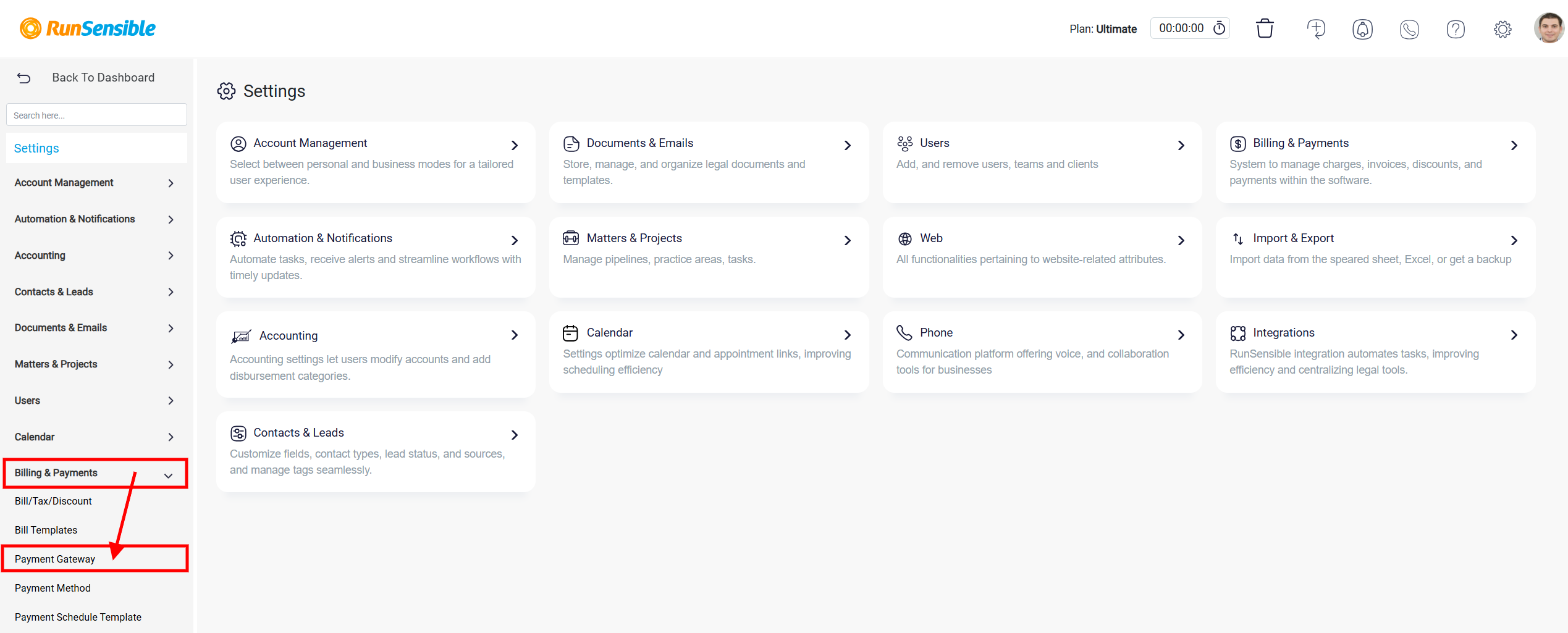

Managing Payment Gateway

To access Payment Gateway, navigate to Settings, select Billing & Payments, and then choose Payment Gateways.

The Payment Types section from the RunSensible platform provides an easy way for users to manage payment collection methods for their clients. It includes multiple options to ensure flexibility and convenience in handling transactions.

One of the available options is Stripe, which allows users to accept credit card payments. The platform clearly outlines Stripe’s pricing structure, with a flat rate of 2.9% + $0.30 per transaction. To start using Stripe, users can click the Get Started button and follow the setup process.

Another payment method offered is PayPal, which enables clients to pay using their PayPal accounts. For PayPal, the interface provides two buttons: Configure for setting up the account and Uninstall for removing it as a payment option. This makes it straightforward to manage the integration.

The platform also supports Square, another popular payment gateway. Like PayPal, Square offers the flexibility to configure or uninstall the service through dedicated buttons. This ensures that users can easily manage their payment preferences without any complications.