Trust Withdrawal

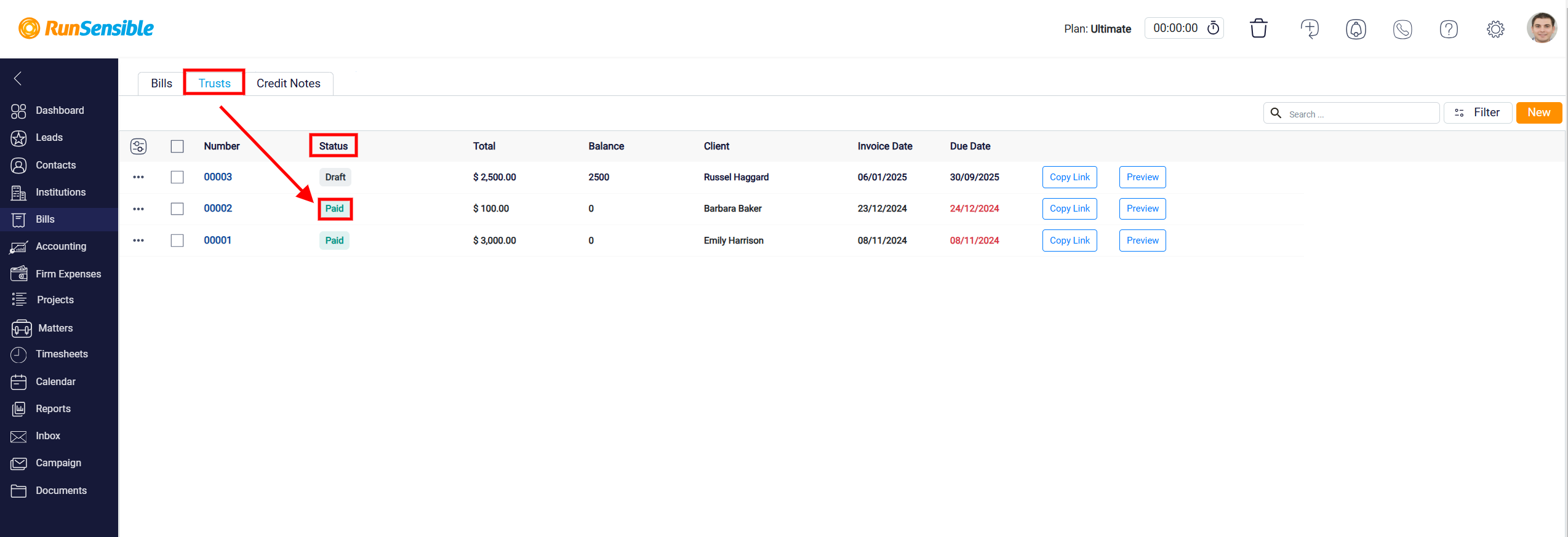

The Paid status indicates that the trust invoice has been fully settled. This status signifies that the total amount specified in the invoice has been successfully received and allocated as per the client’s requirements or instructions. It reflects that all financial obligations associated with the invoice have been fulfilled.

Additionally, the Balance column shows a value of zero for invoices marked as Paid, confirming that there are no outstanding amounts due. This provides clarity and assurance that the specific trust entry has been completed without any pending financial issues.

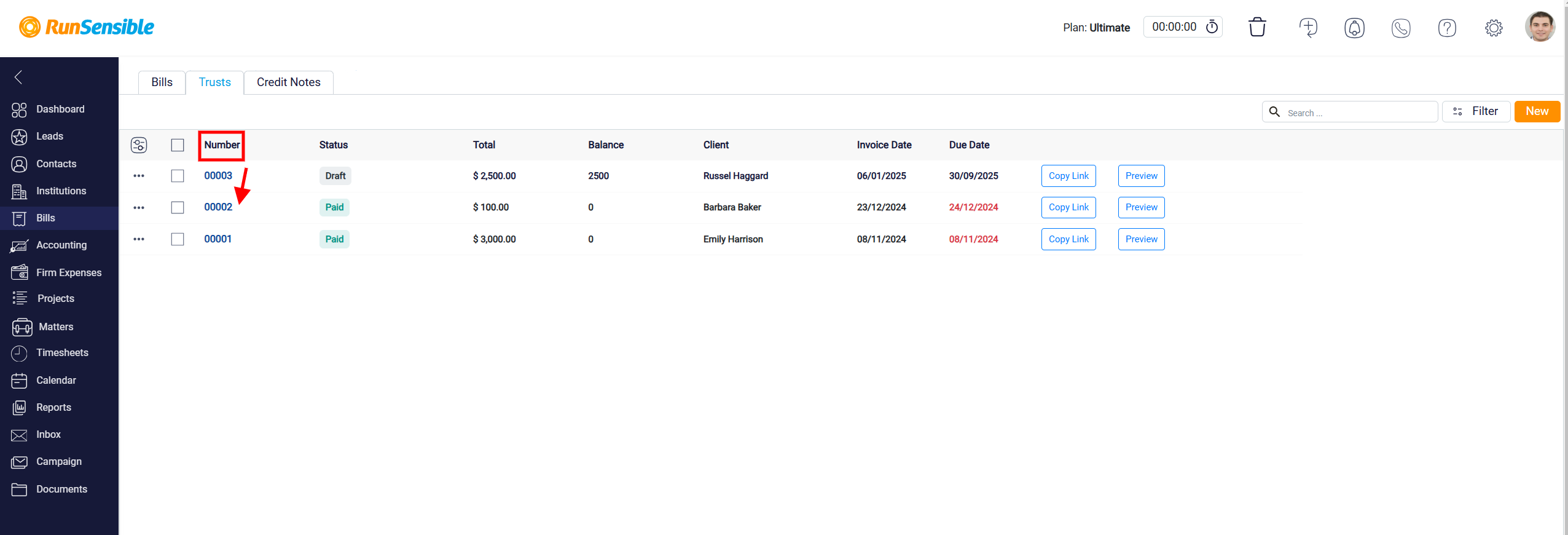

Click on the Paid trust Number to navigate to a detailed page specific to that trust entry.

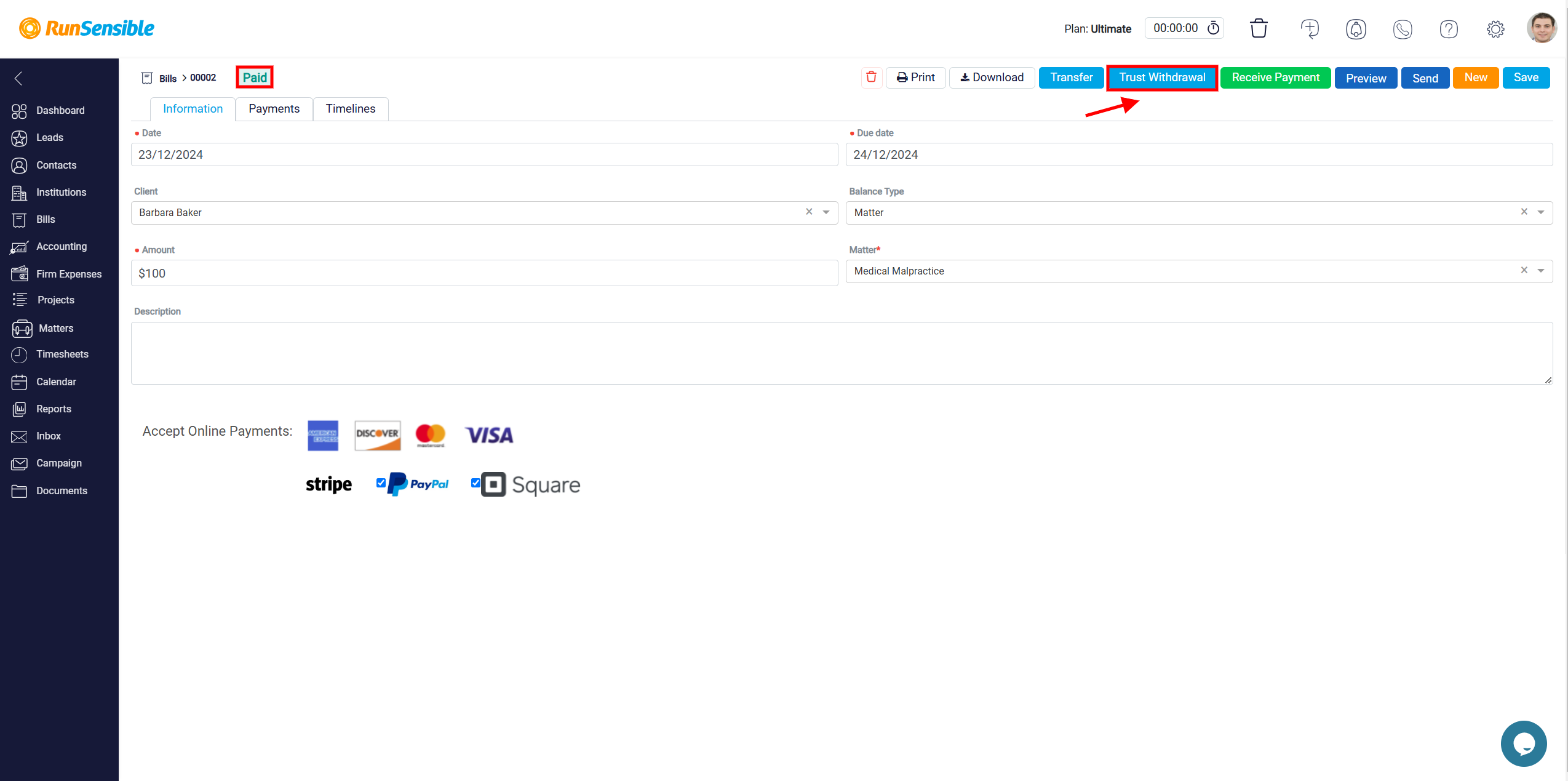

Trust Withdrawal refers to the process of transferring funds from a client’s trust account to the firm’s operating account, typically when the funds are used to pay for services or expenses related to the client’s matter. A trust withdrawal is initiated to move the appropriate amount to the firm’s account. This ensures transparency, proper accounting, and adherence to trust accounting rules. Click on Trust Withdrawal button and navigate to manage trust withdrawal transactions.

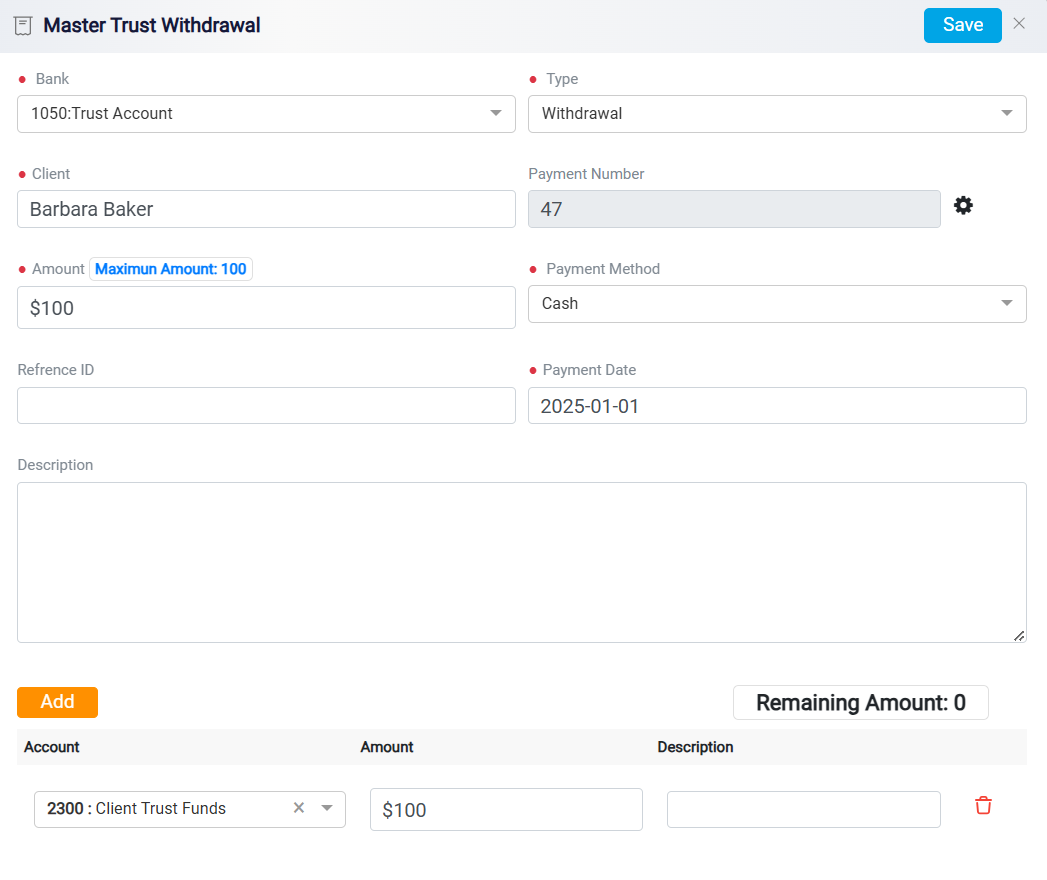

Users can select the specific Bank Account from which funds will be withdrawn, facilitating proper allocation and seamless tracking of transactions across multiple accounts. The form includes a Transaction Type field, allowing users to clearly identify the nature of the action being performed, ensuring compliance with trust account management standards.

The Client field enables the user to link the transaction to a specific client, maintaining a detailed record of which client’s funds are being withdrawn. To streamline tracking and referencing, a unique Payment Number is automatically assigned to each transaction. For detailed instructions please refer to Customizing Payment Number page.

The Amount field specifies the withdrawal amount, with a maximum limit clearly indicated to prevent overdrawing from the trust account. The form also features a Payment Method dropdown, offering flexibility in how the funds are disbursed, and a Payment Date field for accurate record-keeping and scheduling.

For additional tracking or identification, an optional Reference ID field is available, while the Description field allows users to include specific details or notes about the withdrawal, ensuring transparency and clarity regarding the purpose of the transaction.

A dynamic Remaining Amount tracker updates in real time to display how much of the withdrawal has been allocated. For more complex transactions involving multiple accounts, users can use the Add button to include additional accounts, ensuring flexibility. Unnecessary entries can easily be removed using the Trash icon.

Finally, the Save button securely finalizes the transaction once all details are entered and verified, ensuring the record is stored efficiently within the system.