How To Add Tax / Discounts To An Invoice Or Quote

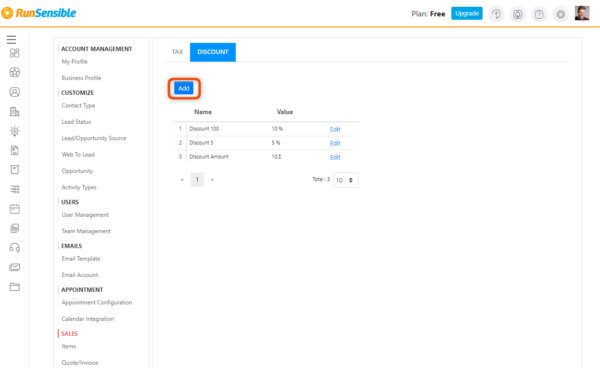

Discounts can be used in dollar amounts or percentages. To create a discount;

-

- On your homepage, click the settings icon

-

- Under the “Sales” section go to “Tax/Discount”

-

- Click on “Discount”

-

- Click “Add”

-

- Enter a name and a value, either in percentages or dollar amount

-

- Click “Save”

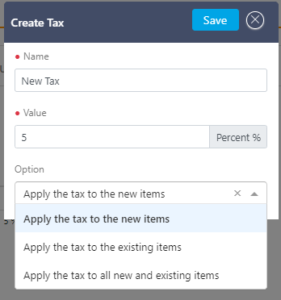

Note: Taxes can only be used in percentages.

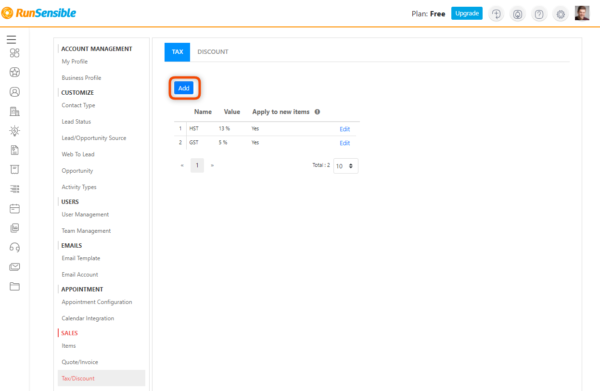

To create a tax percentage:

-

- On your homepage, click the settings icon

-

- Under the “Sales” section go to “Tax/Discount”

-

- Click on “Tax”

-

- Click “Add”

-

- Enter a name, a value, and choose from one of the three tax options;

-

- Click “Save”.

Discounts and taxes can be applied to your invoice in one of two ways; per item or to the transaction as a whole.

To apply a discount/tax per item:

-

- From the menu on the left-hand side, click “Invoices” or “Quotes”

-

- Create a new invoice/quote or select one that has already been drafted

-

- Click on the ellipses in the line item

-

- You can choose from one of your pre-existing discounts created in your settings by clicking “Add Discount” or create a new discount. To add tax simple click “Add Tax”.

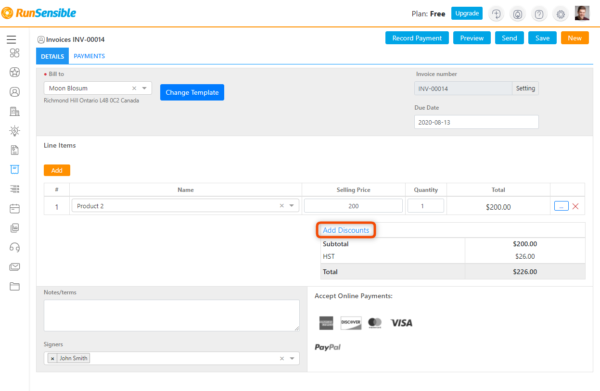

To apply a discount to the transaction as a whole:

-

- From the menu on the left-hand side click “Invoices” or “Quotes”;

-

- Create a new invoice/quote or select one that has already been drafted;

-

- At the bottom of your invoice/quote you will see this;

-

- Simply click on the discount button to apply it to your entire transaction.

Was this post helpful?

Let us know if you liked the post. That’s the only way we can improve.